The True Cost of Credit Card Processing

At Freeform Made, we love our products and want you to love them too. There are a lot of options out there for choosing a POS for your business. It's important to know about each systems' costs and benefits so you can choose the POS sysystem that makes sense for your business.

We are a little OCD when it comes to our products and what may be the best for our customers and potential customers. Recently Square released a slick new POS stand to their offerings. It looks great and can fit great with some businesses. They have two options for this new POS system.

You can either purchase it for $999.99 or $49 a month for 24 months. It offers what seems to be a better deal over their standard set up: this new stand comes a new credit card processing cost structure: 2.5% + 10¢ per tap, dip, or swipe.

The original Square Stand (white) is a flat $199 and Square charges 2.75% per swipe, dip, or tap along with no monthly fees. This pricing holds true if you use Square's stand or the white Square card reader in a Freeform Made enclosure. The original stand sounds like it may not be the best deal, but let's take a closer look.

Their new slate stand is pretty cool; we like the new design. When we crunched some numbers we realized a hidden truth to the new all in one.

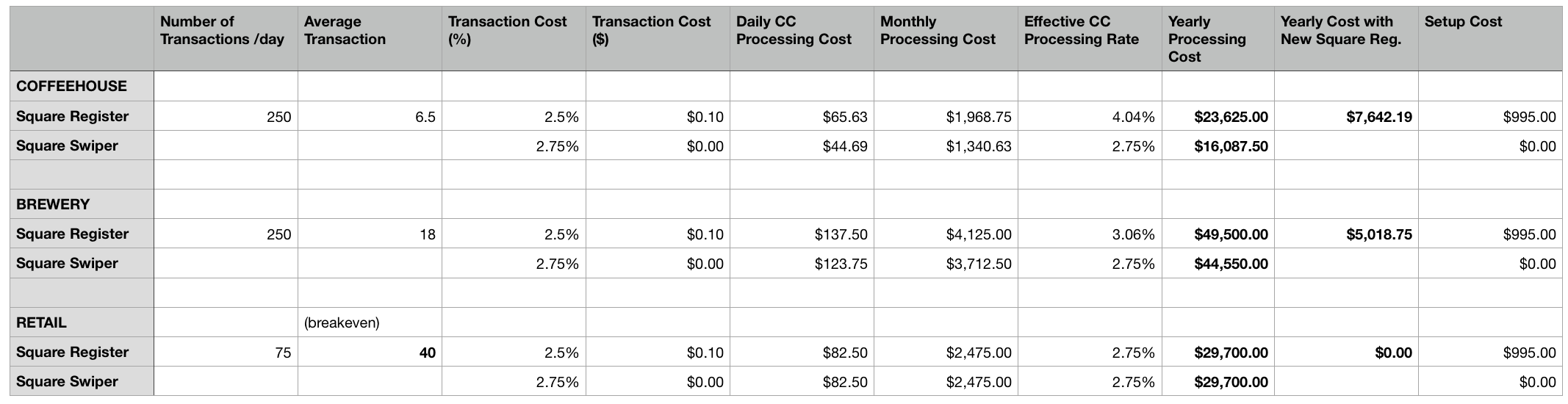

The key here is the average ticket price and the transaction volume. Business who tend to do transactions that are a lower dollar amount, like a coffeeshop, are not seeing as big of a benefit with the new "slate" Square Register. For instance: let's look at a coffee shop where average transaction is $6, maybe they process an average of 250 transaction a day, don't accept cash, and are open year-round. The new “all in one” setup is taking 2.5% + $0.10 / transaction so that is going to be around $65 in credit card transaction fees each day. For a month it comes to about $1,900 and yearly processing adds up to about $23,000.

The same coffeehouse, using a Freeform Stand or the basic Square register setup would end up saving $7,600 a year in credit card costs. Most of this savings is due to the fact that you aren't paying the $0.10 / transaction on every credit card sale.

See the spreadsheet below showing the different types of businesses and the transaction amounts and the cost difference between the square register and the square swiper.

You can download this Google Sheet here.

As you can see, if you have a lower transaction amount, the square register may not be the best option for your business. If you have a higher transaction amount of at least $40 per transaction, then the square "all in one" register wouldn’t be a bad option for your business - you might even save some money! We want all of our customers making the most money their business can make. We would love to see everyone have $40 per transaction! Art galleries, restaurants, and a host of other businesses would likely save on credit card processing costs with the new pricing strategy, but a lot of other businesses would actually spend more in credit card processing using Square's new all-in-one.

At Freeform Made, we love being able to help people make informed decisions about the best products for their businesses. Every business is different, and the end goal is to make a profit. We want you to make the most you can without having to pay high transaction fees.

As always, if you ever have any questions about anything, feel free to email us or give us a call. We are always here to give a helping hand.

Cheers,

Les